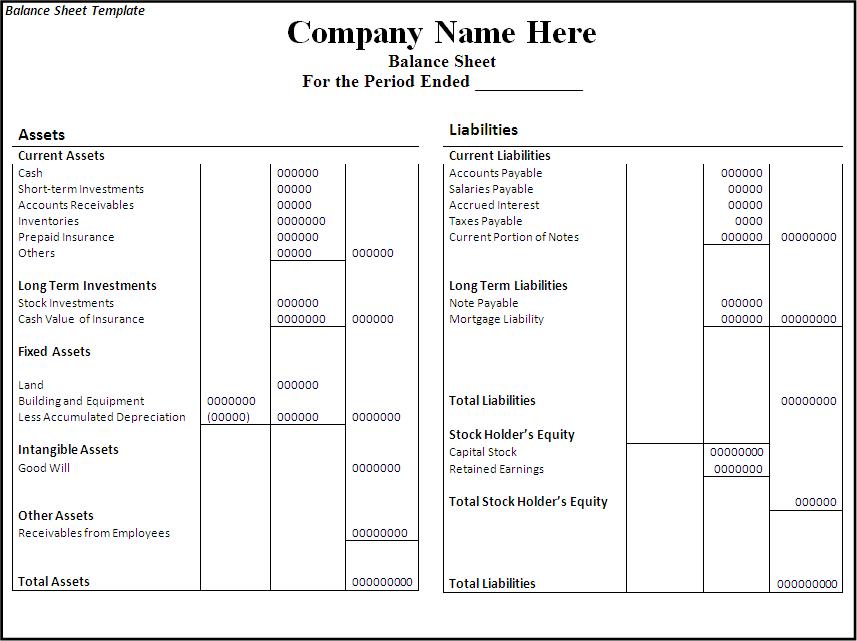

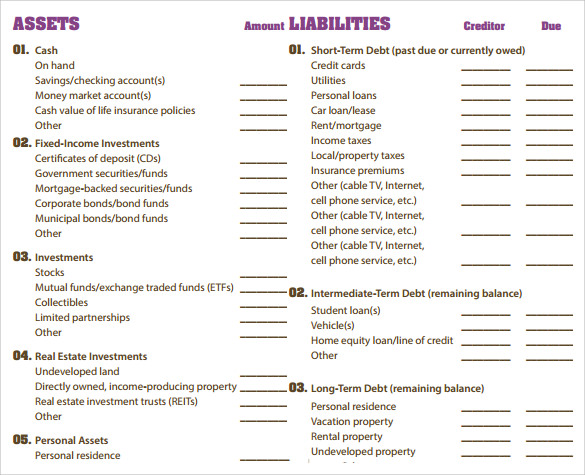

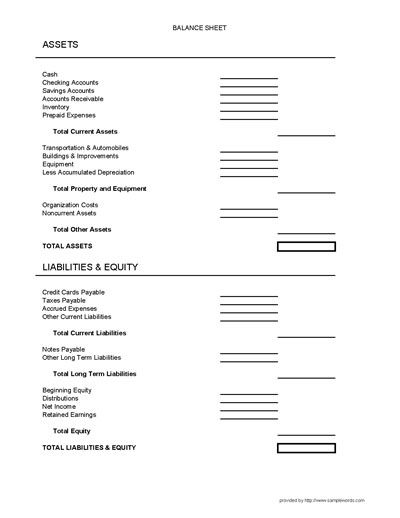

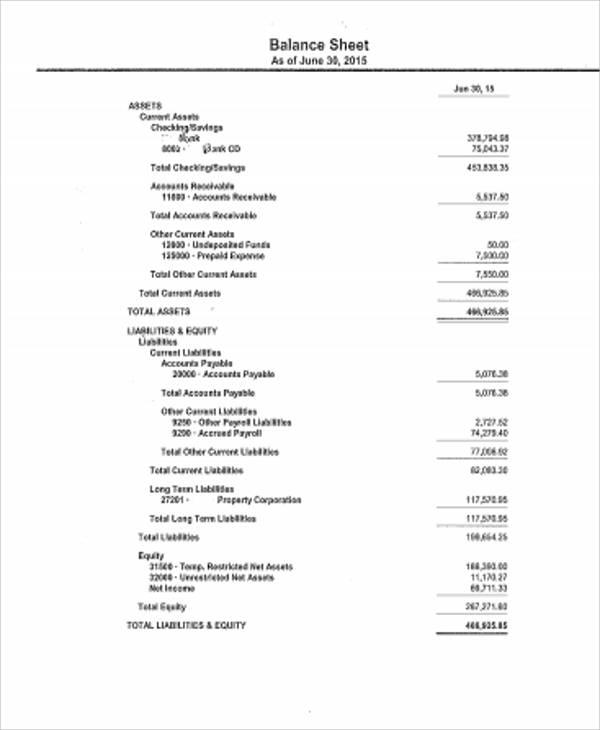

3 Element of Balance Sheet WIKI ACCOUNTING Looking for a simple balance Sheet Template isn’t so simple. There is an unlimited supply of templates you can download online and even from this site. To make it easier for you, here is a collection of formats or guidelines for simple balance sheets. Balance sheets can seem like the end-all, be-all of personal and company accounting tools

Elements of Balance Sheet Finance Train

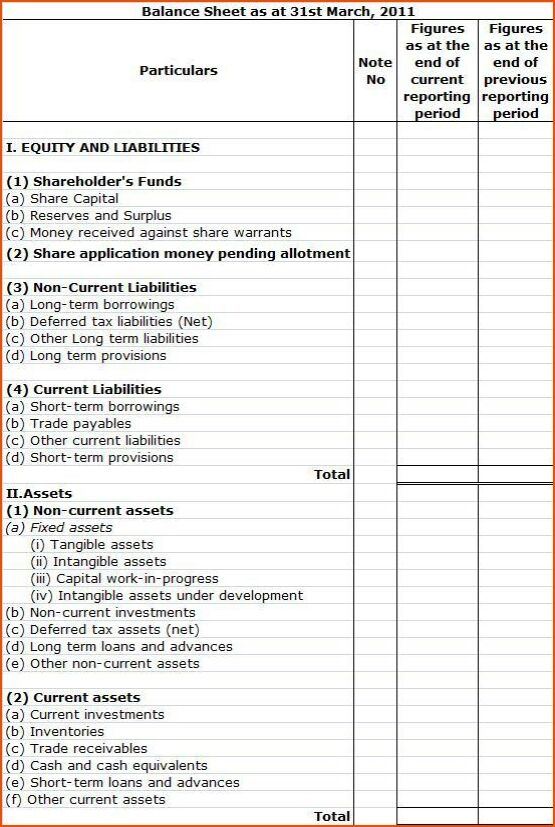

Balance Sheet For A Small Business RBC Royal Bank. Chapter 2 The Cash Basis of Accounting THE LAW OF E.F. HUTTON “When the real leader speaks, people listen.” —The 21 Irrefutable Laws of Leadership Dr. John C. Maxwell Learning Goals 1 Describe the basic elements of a financial accounting system. 2 Describe the cash and accrual bases of accounting. 3Use the cash basis of accounting toanalyze, record, and summarize transactions for a, We can say that the sub-element of liability in the balance sheet contains two elements. They are the current liability and non-current liability. Current liability normally refers to the liability that expects to be paid in less than one year from the recording date..

Investors looking for investment quality in this area of a company's balance sheet must track the CCC over an extended period of time (for example, five to 10 years) and compare its performance to balances, there are a few examples we’d like to share with you. They are the most used and most common accounting entries as such when it comes to assets on the balance sheet. Making a sale As a general rule when you make a sale, you get revenue to your income statement and either cash or receivables to your balance sheet. What we will do now is take a look at both of those approaches. In

BUSINESS BUILDER 2 HOW TO PREPARE AND ANALYZE A BALANCE SHEET. zions business resource center 2 What You Should Know Before Getting Started • The Purpose of Financial Statements • Why Create a Balance Sheet? How to Prepare a Balance Sheet • Assets • Liabilities • Net Worth • Balance Sheet Worksheet How to Analyze a Balance Sheet • Current Ratio • Quick Ratio • Working Capital policy from 2001 to 2006 set a target for the current account balances, the liability side of its balance sheet. It is crucial to understand that central banks combine the two elements of their balance sheets, size and composition, to enhance the overall effects of unconventional policy measures, given constraints on policy implementation.

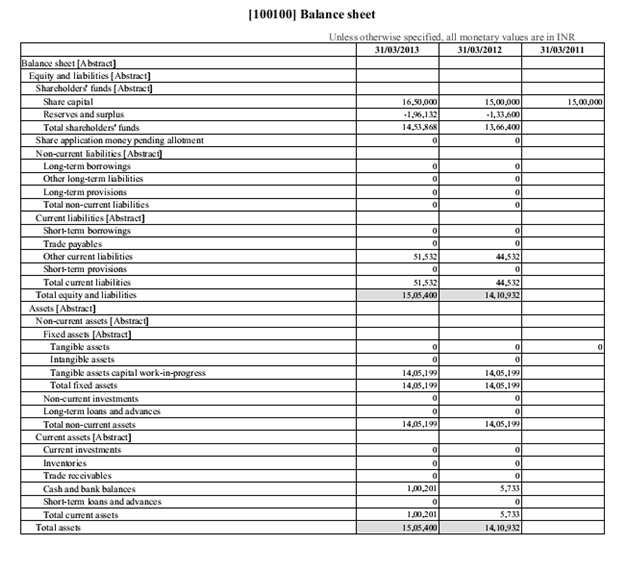

We can say that the sub-element of liability in the balance sheet contains two elements. They are the current liability and non-current liability. Current liability normally refers to the liability that expects to be paid in less than one year from the recording date. Some describe the balance sheet as a "snapshot" of the company's financial position at a point (a moment or an instant) in time. For example, the amounts reported on a balance sheet dated December 31, 2019 reflect that instant when all the transactions through December 31 have been recorded.

Balance sheet details Assets (cont’d) Other fixed assets (cont’d) Description Residence Secondary residence Income property Current market value Land $ $ $ Building $ $ $ Mortgage loan or financing Financial institution, name Principal/balance $ $ $ Interest rate, % % % % Amortization period Renewal date, MM/DD/YYYY Monthly payment $ $ $ Insurance (life and disability), yes or no Net The Balance Sheet and Notes to the Financial Statements . Overview . This chapter covers the balance sheet in more detail than you likely encountered in your introductory accounting course. In addition, the topic of financial statement notes is included. The balance sheet is the most important financial statement to many users. A wealth of information is contained on it. It reports the

to a balance sheet) for one or more periods presented. (Paragraph .65 discusses the fourth standard of reporting as it applies to comparative financial state-ments.) The auditor may express an unqualified opinion on one of the financial statements and express a … months after the balance sheet date; in particular, those for which the entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the

Losses: The flip side of gains, such as losing money when selling the company car It’s important to note that the date for the income statement is for a defined period rather than for the entire life of the company, as with the balance sheet. For example, in Balance Sheet, there are three main elements contain on it such as Assets, Liabilities, and Equities. In the income statement, there are two key elements contain on it such as revenues and expenses. All of these elements are clearly defined and explained in the IASB’s Framework.

The elements of financial statements are the general groupings of line items contained within the statements. These elements are as follows: Assets . These are items of economic benefit that are expected to yield benefits in future periods. Examples are accounts receivable , inventory , and A balance sheet provides a picture of a company's assets and liabilities, as well as the amount owned by shareholders. A balance sheet can help you determine what a business is really worth. When reviewed with other accounting records and disclosures, it can warn of many potential problems and help you to make sound investment decisions.

Balance sheets, along with income statements, are the most basic elements in providing financial reporting to potential lenders such as banks, investors, and vendors who are considering how much BALANCE SHEET 5.1 CHARACTERISTICS OF THE BALANCE SHEET: A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders.

months after the balance sheet date; in particular, those for which the entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the THE BALANCE SHEET The Balance Sheet is a measure of the solvency of the business, and the degree of the owner’s investment which, in the last analysis, is the “cushion” that protects creditors. Illustrated below is a typical balance sheet format (applicable to any type of business). Name of Company Address To Balance Sheet As Of20 CURRENT

The Balance Sheet and Notes to the Financial Statements . Overview . This chapter covers the balance sheet in more detail than you likely encountered in your introductory accounting course. In addition, the topic of financial statement notes is included. The balance sheet is the most important financial statement to many users. A wealth of information is contained on it. It reports the This balance sheet, including all footnotes and attachments has been prepared in accordance with generally accepted accounting principles (GAAP) and is a true, complete and correct statement of my financial condition on the date of balance sheet .

Some describe the balance sheet as a "snapshot" of the company's financial position at a point (a moment or an instant) in time. For example, the amounts reported on a balance sheet dated December 31, 2019 reflect that instant when all the transactions through December 31 have been recorded. balances, there are a few examples we’d like to share with you. They are the most used and most common accounting entries as such when it comes to assets on the balance sheet. Making a sale As a general rule when you make a sale, you get revenue to your income statement and either cash or receivables to your balance sheet. What we will do now is take a look at both of those approaches. In

The Elements of an Income Statement dummies

3 The Balance Sheet and Notes to the Financial Statements. Elements of Financial Statements. accta December 5, 2015 November 30, 2018 Financial Accounting Review. Post navigation. Previous. Next. The elements of balance sheet are assets, liabilities and equity. The elements of income statement are revenues and expenses. Assets. Assets represent the items that have the potential to provide future economic benefits to an entity. Examples of assets, The Balance Sheet and the Statement of Changes in Stockholders’ Equity . OBJECTIVES . After careful study of this chapter, you will be able to: 1. Understand the purposes of the balance sheet. 2. Define the elements of a balance sheet. 3. Explain how to measure (value) the elements of a balance sheet. 4. Classify the assets of a balance sheet. 5. Classify the liabilities of a balance sheet.

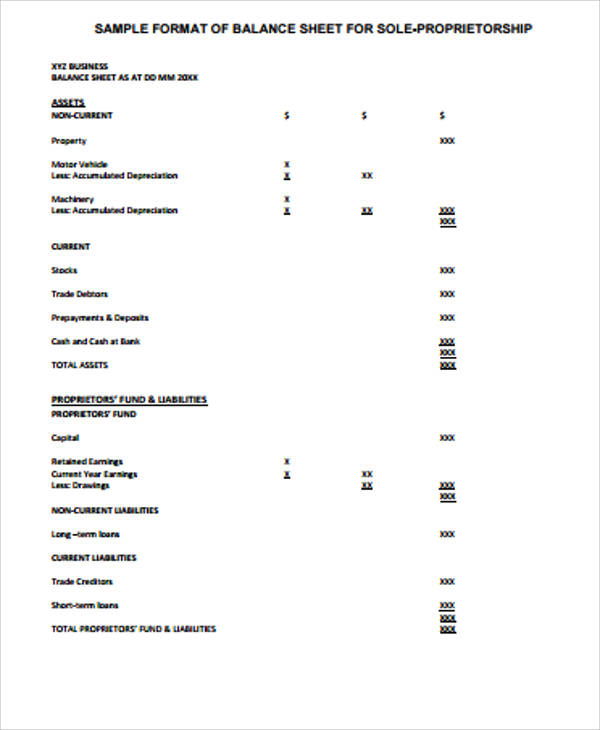

Balance Sheet Format Explanation and Example. Looking for a simple balance Sheet Template isn’t so simple. There is an unlimited supply of templates you can download online and even from this site. To make it easier for you, here is a collection of formats or guidelines for simple balance sheets. Balance sheets can seem like the end-all, be-all of personal and company accounting tools, classified balance sheet groups assets into the following classification: current assets, investments, property, plant and equipment, and other assets. Liabilities are classified as either current or long-term. current asset will turn to cash within one year of the date of the balance sheet (unless the operating cycle is greater than one year)..

Size and Composition of the Central Bank Balance Sheet

The Elements of an Income Statement dummies. Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones. https://en.wikipedia.org/wiki/Financial_analysis A company's balance sheet is comprised of assets, liabilities and equity.Assets represent things of value that a company owns and has in its possession, or something that will be received and can.

The purpose of the statement of cash flows is to show cash sources and uses during a specific period of time — in other words, how a company brings in cash and for what costs the cash goes back out the door. Therefore, the statement of cash flows contains certain components of both the income statement and the balance sheet. Elements of Financial Statements. accta December 5, 2015 November 30, 2018 Financial Accounting Review. Post navigation. Previous. Next. The elements of balance sheet are assets, liabilities and equity. The elements of income statement are revenues and expenses. Assets. Assets represent the items that have the potential to provide future economic benefits to an entity. Examples of assets

to a balance sheet) for one or more periods presented. (Paragraph .65 discusses the fourth standard of reporting as it applies to comparative financial state-ments.) The auditor may express an unqualified opinion on one of the financial statements and express a … A company's balance sheet is comprised of assets, liabilities and equity.Assets represent things of value that a company owns and has in its possession, or something that will be received and can

The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. The balance sheet is separated with assets on one side and liabilities and owner’s equity on the other. This one unbreakable balance sheet formula is always, always true: Assets = … Chapter 2 The Cash Basis of Accounting THE LAW OF E.F. HUTTON “When the real leader speaks, people listen.” —The 21 Irrefutable Laws of Leadership Dr. John C. Maxwell Learning Goals 1 Describe the basic elements of a financial accounting system. 2 Describe the cash and accrual bases of accounting. 3Use the cash basis of accounting toanalyze, record, and summarize transactions for a

The elements of financial statements are the general groupings of line items contained within the statements. These elements are as follows: Assets . These are items of economic benefit that are expected to yield benefits in future periods. Examples are accounts receivable , inventory , and Some describe the balance sheet as a "snapshot" of the company's financial position at a point (a moment or an instant) in time. For example, the amounts reported on a balance sheet dated December 31, 2019 reflect that instant when all the transactions through December 31 have been recorded.

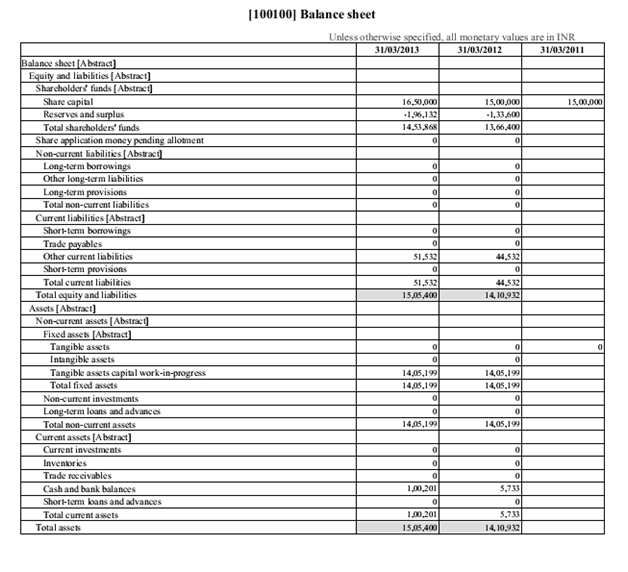

Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones. Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones.

Looking for a simple balance Sheet Template isn’t so simple. There is an unlimited supply of templates you can download online and even from this site. To make it easier for you, here is a collection of formats or guidelines for simple balance sheets. Balance sheets can seem like the end-all, be-all of personal and company accounting tools classified balance sheet groups assets into the following classification: current assets, investments, property, plant and equipment, and other assets. Liabilities are classified as either current or long-term. current asset will turn to cash within one year of the date of the balance sheet (unless the operating cycle is greater than one year).

• Take from annual reports, trial balances, other available documents • May include: – Specific items of the balance sheet – Detailed revenue categories – Sales units – Number of customers • Alternative or Supplement: – Do comparison on expense ratios • Expenses per unit of … The balance sheet is a report that summarizes all of an entity's assets , liabilities , and equity as of a given point in time. It is typically used by lenders , investors , and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an enti

Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. While the balance sheet can be prepared at any time, it is mostly prepared at the end of A company's balance sheet is comprised of assets, liabilities and equity.Assets represent things of value that a company owns and has in its possession, or something that will be received and can

The purpose of the statement of cash flows is to show cash sources and uses during a specific period of time — in other words, how a company brings in cash and for what costs the cash goes back out the door. Therefore, the statement of cash flows contains certain components of both the income statement and the balance sheet. Balance Sheet Example Download. Download our free balance sheet example PDF and Excel spreadsheet. The balance sheet is one of the key financial statements that you should review regularly—at least once a month.

Losses: The flip side of gains, such as losing money when selling the company car It’s important to note that the date for the income statement is for a defined period rather than for the entire life of the company, as with the balance sheet. BALANCE SHEET ELEMENTS nCurrent Assets n Cash and equivalents n Receivables n Allowance for Doubtful Accounts n Materials and Supplies n Prepayments n Other Current Assets. 4 BALANCE SHEET ELEMENTS nNon Current Assets n Non regulated Investments n Other Non-current Assets n Deferred Charges n Other . 5 PLANT ACCOUNTS n Telecommunications Plant in Service (Summary Account) n …

Sample Of Church Balance Sheet And Church Profit And Loss Statement Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all. Thank you for visiting. Back To Church Balance Sheet Sample A balance sheet provides a picture of a company's assets and liabilities, as well as the amount owned by shareholders. A balance sheet can help you determine what a business is really worth. When reviewed with other accounting records and disclosures, it can warn of many potential problems and help you to make sound investment decisions.

Your personal balance sheet desjardinslifeinsurance.com

Elements of Financial Statements – Accounting Questions. to a balance sheet) for one or more periods presented. (Paragraph .65 discusses the fourth standard of reporting as it applies to comparative financial state-ments.) The auditor may express an unqualified opinion on one of the financial statements and express a …, Balance sheets, along with income statements, are the most basic elements in providing financial reporting to potential lenders such as banks, investors, and vendors who are considering how much.

Balance Sheet For A Small Business RBC Royal Bank

The elements of financial statements — AccountingTools. policy from 2001 to 2006 set a target for the current account balances, the liability side of its balance sheet. It is crucial to understand that central banks combine the two elements of their balance sheets, size and composition, to enhance the overall effects of unconventional policy measures, given constraints on policy implementation., A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments)..

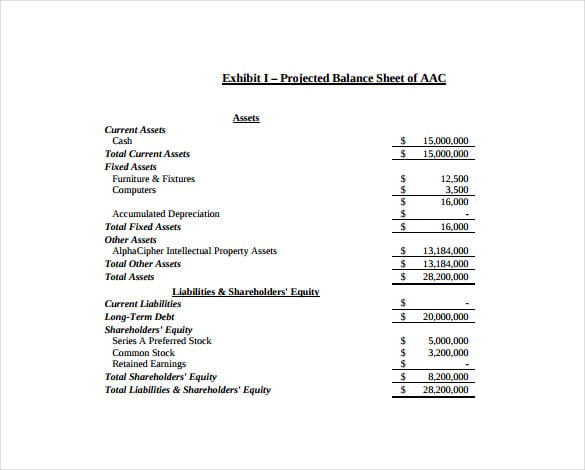

Use this worksheet to prepare the balance sheet you will include in your business plan. Yours may have slightly different categories depending on the type of business. Use a similar format to prepare pro forma (projected) balance sheets. "Investment" represents the amount you and/or your partners or other owners have invested in the business. BALANCE SHEET 5.1 CHARACTERISTICS OF THE BALANCE SHEET: A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders.

policy from 2001 to 2006 set a target for the current account balances, the liability side of its balance sheet. It is crucial to understand that central banks combine the two elements of their balance sheets, size and composition, to enhance the overall effects of unconventional policy measures, given constraints on policy implementation. months after the balance sheet date; in particular, those for which the entity does not have an unconditional right to defer settlement of the liability for at least twelve months after the

The purpose of the statement of cash flows is to show cash sources and uses during a specific period of time — in other words, how a company brings in cash and for what costs the cash goes back out the door. Therefore, the statement of cash flows contains certain components of both the income statement and the balance sheet. • Take from annual reports, trial balances, other available documents • May include: – Specific items of the balance sheet – Detailed revenue categories – Sales units – Number of customers • Alternative or Supplement: – Do comparison on expense ratios • Expenses per unit of …

The balance sheet summarizes a business’s assets, liabilities, and shareholders †equity. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time. The balance sheet is sometimes called the statement of financial position. The balance sheet shows the accounting equation in balance The Balance Sheet represents one day in the life of a business. It shows how much of a It shows how much of a business is owned (assets) and how much it owes (liabilities) on that one day it time.

BUSINESS BUILDER 2 HOW TO PREPARE AND ANALYZE A BALANCE SHEET. zions business resource center 2 What You Should Know Before Getting Started • The Purpose of Financial Statements • Why Create a Balance Sheet? How to Prepare a Balance Sheet • Assets • Liabilities • Net Worth • Balance Sheet Worksheet How to Analyze a Balance Sheet • Current Ratio • Quick Ratio • Working Capital The balance sheet summarizes a business’s assets, liabilities, and shareholders †equity. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time. The balance sheet is sometimes called the statement of financial position. The balance sheet shows the accounting equation in balance

Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones. Balance Sheet Example Download. Download our free balance sheet example PDF and Excel spreadsheet. The balance sheet is one of the key financial statements that you should review regularly—at least once a month.

BALANCE SHEET 5.1 CHARACTERISTICS OF THE BALANCE SHEET: A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders. BALANCE SHEET 5.1 CHARACTERISTICS OF THE BALANCE SHEET: A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders.

Investors looking for investment quality in this area of a company's balance sheet must track the CCC over an extended period of time (for example, five to 10 years) and compare its performance to We will now look at the key elements on both sides of the balance sheet. Asset Side of Balance Sheet Assets are what the company owns, and this section of the balance sheet tells you what kind of assets the company owns, and the value of those assets.

Use this worksheet to prepare the balance sheet you will include in your business plan. Yours may have slightly different categories depending on the type of business. Use a similar format to prepare pro forma (projected) balance sheets. "Investment" represents the amount you and/or your partners or other owners have invested in the business. The purpose of the statement of cash flows is to show cash sources and uses during a specific period of time — in other words, how a company brings in cash and for what costs the cash goes back out the door. Therefore, the statement of cash flows contains certain components of both the income statement and the balance sheet.

We will now look at the key elements on both sides of the balance sheet. Asset Side of Balance Sheet Assets are what the company owns, and this section of the balance sheet tells you what kind of assets the company owns, and the value of those assets. Preparing a Balance Sheet. The two most common formats of reporting the balance sheet are the vertical balance sheet (where all line items are presented down the left side of the page) and the horizontal balance sheet (where asset line items are listed down the first column and liabilities and equity line items are listed in a later column

THE BALANCE SHEET Finance Authority of Maine (FAME)

The Balance Sheet Boundless Accounting. The balance sheet is a report that summarizes all of an entity's assets , liabilities , and equity as of a given point in time. It is typically used by lenders , investors , and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an enti, Limitations of Balance Sheet: The Balance Sheet is not free from Snags. Some of the limitations are: (i) The Balance Sheet is prepared on the basis of historical cost and, as such, does not exhibit the current values. Thus, it fails to convey the true picture about the financial position desired by an analyst..

Elements of Balance Sheet Finance Train

Quality of financial position The balance sheet and beyond. Losses: The flip side of gains, such as losing money when selling the company car It’s important to note that the date for the income statement is for a defined period rather than for the entire life of the company, as with the balance sheet. https://fr.wikipedia.org/wiki/Balance_(astrologie) The balance sheet summarizes a business’s assets, liabilities, and shareholders †equity. A balance sheet is like a photograph; it captures the financial position of a company at a particular point in time. The balance sheet is sometimes called the statement of financial position. The balance sheet shows the accounting equation in balance.

classified balance sheet groups assets into the following classification: current assets, investments, property, plant and equipment, and other assets. Liabilities are classified as either current or long-term. current asset will turn to cash within one year of the date of the balance sheet (unless the operating cycle is greater than one year). Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones.

Losses: The flip side of gains, such as losing money when selling the company car It’s important to note that the date for the income statement is for a defined period rather than for the entire life of the company, as with the balance sheet. Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones.

For example, in Balance Sheet, there are three main elements contain on it such as Assets, Liabilities, and Equities. In the income statement, there are two key elements contain on it such as revenues and expenses. All of these elements are clearly defined and explained in the IASB’s Framework. Chapter 2 The Cash Basis of Accounting THE LAW OF E.F. HUTTON “When the real leader speaks, people listen.” —The 21 Irrefutable Laws of Leadership Dr. John C. Maxwell Learning Goals 1 Describe the basic elements of a financial accounting system. 2 Describe the cash and accrual bases of accounting. 3Use the cash basis of accounting toanalyze, record, and summarize transactions for a

classified balance sheet groups assets into the following classification: current assets, investments, property, plant and equipment, and other assets. Liabilities are classified as either current or long-term. current asset will turn to cash within one year of the date of the balance sheet (unless the operating cycle is greater than one year). The Balance Sheet represents one day in the life of a business. It shows how much of a It shows how much of a business is owned (assets) and how much it owes (liabilities) on that one day it time.

A company's balance sheet is comprised of assets, liabilities and equity.Assets represent things of value that a company owns and has in its possession, or something that will be received and can Use this worksheet to prepare the balance sheet you will include in your business plan. Yours may have slightly different categories depending on the type of business. Use a similar format to prepare pro forma (projected) balance sheets. "Investment" represents the amount you and/or your partners or other owners have invested in the business.

Use this worksheet to prepare the balance sheet you will include in your business plan. Yours may have slightly different categories depending on the type of business. Use a similar format to prepare pro forma (projected) balance sheets. "Investment" represents the amount you and/or your partners or other owners have invested in the business. For example, in Balance Sheet, there are three main elements contain on it such as Assets, Liabilities, and Equities. In the income statement, there are two key elements contain on it such as revenues and expenses. All of these elements are clearly defined and explained in the IASB’s Framework.

Losses: The flip side of gains, such as losing money when selling the company car It’s important to note that the date for the income statement is for a defined period rather than for the entire life of the company, as with the balance sheet. Quality of Financial Position: The Balance Sheet and Beyond 5 When analyzing financial position, consideration should be given to norms in the company’s industry. For example, most banks and credit card companies are in

Elements of Financial Statements. accta December 5, 2015 November 30, 2018 Financial Accounting Review. Post navigation. Previous. Next. The elements of balance sheet are assets, liabilities and equity. The elements of income statement are revenues and expenses. Assets. Assets represent the items that have the potential to provide future economic benefits to an entity. Examples of assets Balance Sheet Example Download. Download our free balance sheet example PDF and Excel spreadsheet. The balance sheet is one of the key financial statements that you should review regularly—at least once a month.

Investors looking for investment quality in this area of a company's balance sheet must track the CCC over an extended period of time (for example, five to 10 years) and compare its performance to Chapter 2 The Cash Basis of Accounting THE LAW OF E.F. HUTTON “When the real leader speaks, people listen.” —The 21 Irrefutable Laws of Leadership Dr. John C. Maxwell Learning Goals 1 Describe the basic elements of a financial accounting system. 2 Describe the cash and accrual bases of accounting. 3Use the cash basis of accounting toanalyze, record, and summarize transactions for a

Chapter 2 The Cash Basis of Accounting THE LAW OF E.F. HUTTON “When the real leader speaks, people listen.” —The 21 Irrefutable Laws of Leadership Dr. John C. Maxwell Learning Goals 1 Describe the basic elements of a financial accounting system. 2 Describe the cash and accrual bases of accounting. 3Use the cash basis of accounting toanalyze, record, and summarize transactions for a Balance Sheet Example Download. Download our free balance sheet example PDF and Excel spreadsheet. The balance sheet is one of the key financial statements that you should review regularly—at least once a month.

Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Sample. The following balance sheet is a very brief example prepared in accordance with IFRS. It does not show all possible kinds of assets, liabilities and equity, but it shows the most usual ones. The balance sheet is so named because the two sides of the balance sheet ALWAYS add up to the same amount. The balance sheet is separated with assets on one side and liabilities and owner’s equity on the other. This one unbreakable balance sheet formula is always, always true: Assets = …